The Constitutional Maze: How Federal Law Shapes America’s $70+ Billion Unclaimed Property System

The U.S. Supreme Court had to intervene when Delaware decided to claim the unclaimed property on incorporation, and another state tried to claim the same property based on the major business location of the company. The decision transformed the nature of the interaction of the interstate commerce law with the rights of the states to their property and left a timeless precedent.

Jurisdictional issues are also critical with over $70 billion of the unclaimed property being custodial to the state programmes at present. One of the issues that is not always easy to resolve is determining the state of possession of property to businesses and persons with connections across state borders.

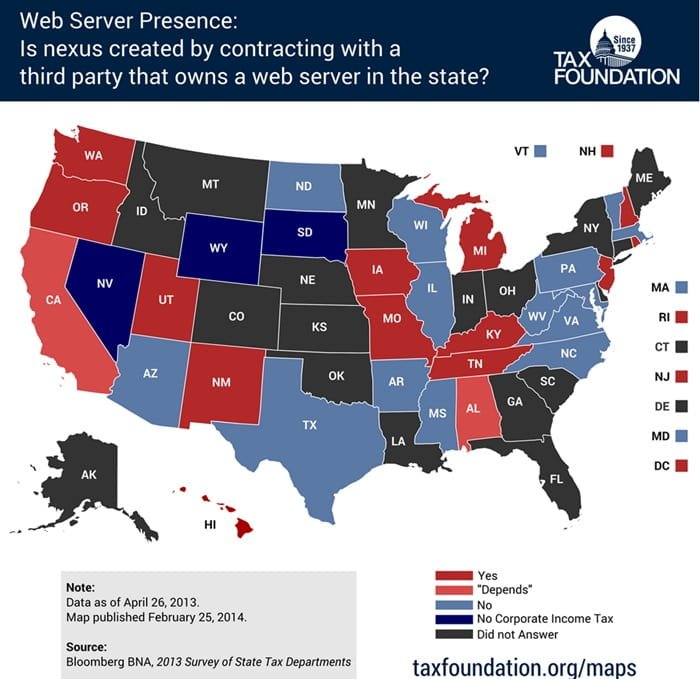

Figure. State-by-state map showing whether a web server presence creates corporate tax nexus, highlighting wide variation in U.S. tax rules.

In the intersections between federal commerce law, constitutional rights, and state sovereignty, a dispute arises over who owns and manages what. This paper will look at the constitutional underpinnings, Supreme Court precedents, federal law, and the implications in practical application that define the approach to unclaimed property in the multi-state mix.

The Commerce Clause Foundation: Federal Constitutional Framework

The Commerce Clause permits Congress to regulate the commerce between states and it is the focal point in conflict over multi-state unclaimed property. The interstate harmony is guaranteed by the federal constitution when there are conflicting claims between two states and economic instability is avoided.

- Dormant Commerce Clause: The clause is against state laws that unreasonably burden interstate commerce, an important restriction in the case of a conflict between disclosure or custody rules.

- Due Process Clause: Ensures that there is fairness when states give notice to owners and bring claims especially in a case where assets are located in many jurisdictions.

- Full Faith and Credit: Requires the states to acknowledge judgments of one another but there are always some disagreements.

- Supremacy Clause: Provides that the federal law will take precedence over any conflict of state laws.

- Equal Protection: Imposes upon the Court the duty to apply similar claims to the same treatment by the Court in different jurisdictions.

- Takings Clause: Prohibits the misuse of property appropriation by states against the constitutional protection.

There is also the explicit commerce power that Congress has in legislating on the issues of interstate unclaimed property, though it has tended to leave the courts to apply the law. These principles in combination create a system of constitutional checks and balances between the state and the federal government.

Supreme Court Precedent: Landmark Cases Shaping Multi-State Claims

The decisions of the Supreme Court have been resolute in establishing the principles to be followed when it comes to interstate unclaimed property cases:

- Texas v. New Jersey (1965): The priority rules that are still in use today were put in place, first in order of the state of the last known address of the owner, then in order of the state of incorporation.

- Pennsylvania v. New York (1972): Extended the same framework to money orders, and made consistency stronger.

- Delaware v. New York (1993): Provided an explanation of the influence of corporate intermediaries on jurisdiction, in which Delaware is advantaged as an incorporation venue in many companies.

- International Paper Co. v. Massachusetts (1918): An early case that appreciated constitutional restrictions on the interstate taxation of property.

- Franchise Tax Board v. Hyatt (2019): Cross-border limits on private cross-state litigation by affirming the sovereign immunity of states in cross-state litigation.

Such cases mirror the balancing exercise of the Court that guarantees fairness, prevents cases with duplicity and ensures clarity in interstate commerce. Still there are loopholes and litigation continues and the federal legislation is demanded.

Federal Legislation and Regulatory Framework

Even though the majority of unclaimed property law is state-based, federal laws and agencies influence the overall pattern:

- Uniform Disposition of Unclaimed Property Act (UPDPA): This is a model statute that affects, but does not standardize state laws.

- FDIC regulations: Bank deposit abandonment.

- SEC supervision: It affects securities, dividends and brokerage accounts.

- ERISA preemption: State claims are conflicted with by federal pension law.

- IRS coordination: Ensuring tax obligations are aligned when assets are recovered.

- FTC consumer protections: Regulating transparency and fair treatment in property claims.

- Bankruptcy Code: Governing abandoned assets during insolvency.

The complexity of aligning federal interstate commerce requirements with divergent state systems is why many Americans turn to Claim Notify. ClaimNotify can streamline access to official resources, enabling individuals and businesses to be aware of jurisdictional issues before recovery efforts begin.

Jurisdictional Conflicts and Resolution Mechanisms

In cases involving several states, which claim the same premise, the law of primacy determined by Supreme Court precedents is applied. Typically, the state of the last known address prevails. If no address exists, the state of incorporation claims custody.

But new business habits are making it hard: multi-nationals, subsidiaries, and electronic transactions all water down traditional boundaries. States can sign interstate compacts to settle a dispute but the ultimate authority is the federal court.

The arbitration agreements, conflict of laws doctrines and administrative dispute processes have a contribution as well. States cooperate in collection and distribution in some cases by having reciprocal enforcement agreements.

Regardless of these mechanisms, overlapping obligations are common to every business and the owners have chaos in their records. The system is not uniformly covered by federal legislation, and therefore is likely to be litigious.

Practical Implications for Property Owners and Businesses

For property owners, multi-state claims mean expanding searches beyond a single jurisdiction. Official state government databases must be checked across all potential connections. Documentation standards differ; what one state accepts may not satisfy another.

There are huge compliance obligations on the businesses. Multi-state operations have to submit their annual reports in all of the jurisdictions with different deadlines and formats. Record keeping is of the essence and the penalties of under-reporting can be substantial.

Estate planning is also a matter. Clients who are heirs to assets in more than one state can have conflicting statutes of limitation, overlapping claims and tax liabilities. The fact that federal immigration and tax law can also be used to influence eligibility also presents a layer of complexity due to international heirs.

When it comes to both businesses and individuals, there may be a need to seek specialized legal advice to help in sorting out the federal and state guidelines that overlap in the unclaimed property.

Navigating the Federal-State Balance in Unclaimed Property Law

The unclaimed property system illustrates how subtle the relationship between state sovereignty and the federal constitutional power is. There are rules at the bottom of the cases, on which Supreme Court precedent relies, yet there are loopholes in an economy that is characterized by interstate and digital dealings.

Understanding both federal and state legal requirements is critical for successful recovery. Such tools as ClaimNotify assist individuals and companies in moving their way through this maze, to provide some clarity in a disjointed system.

Moving forward, closer ties between the federal and state governments and possible changes in the laws would make the conflict and property owners safer. Up to that point, awareness, compliance and proactive planning is the key to managing unclaimed property on an interstate basis.